Archived: Mid-2016 Capital Markets Update

April 2016: Delinquency Rates Mitigating fear of CMBS Wave

Commentary

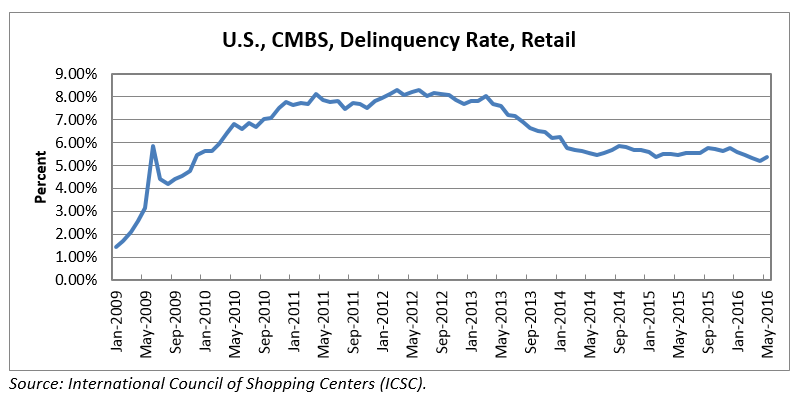

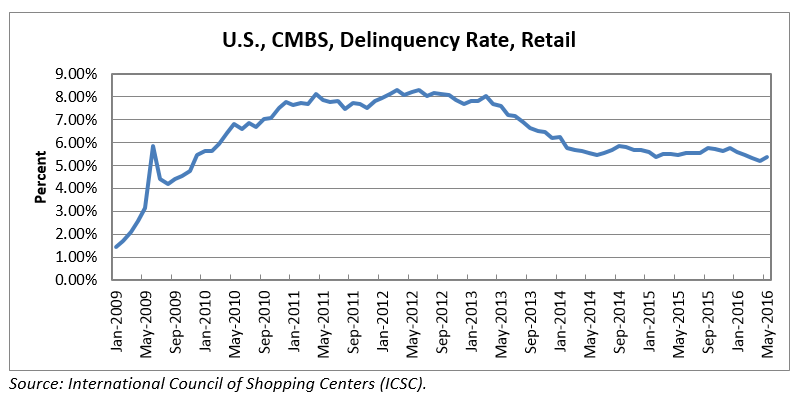

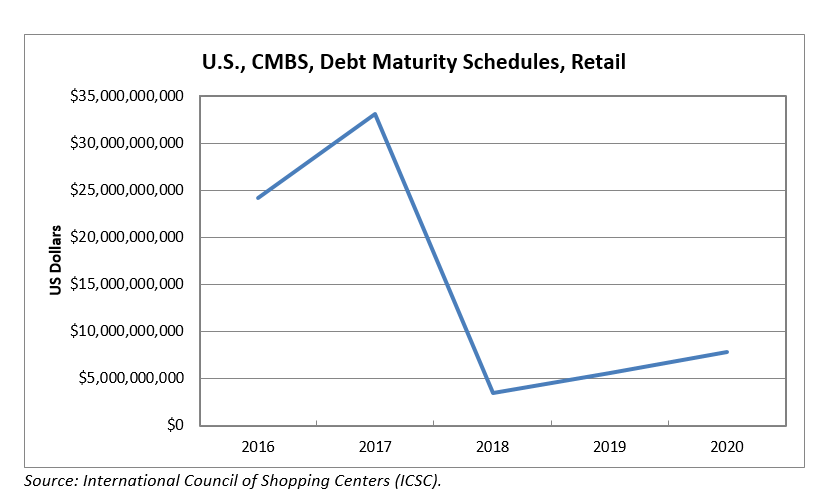

For the retail sector, current delinquency rates were at 5.36% through the end of May, up 15 basis points from April. As of right now, the wave of CMBS maturities appears to lack momentum through this quarter. However, the tide could turn as more CMBS loans are due to mature in the coming year. The peak is expected to be July/August of 2017 (10-year notes from 2007). In 2017, the amount of CMBS loans scheduled for maturity will increase by 37%, from $24 billion to $33 billion.

What We Read:

1. Could a Brexit bring more CRE investors to U.S. Shores? http://nreionline.com/investment/brexit-could-bring-more-cre-investors-us-shores

2. PIMCO recently published a contrarian research brief

https://www.pimco.com/insights/investment-strategies/featured-solutions/us-real-estate-a-storm-is-brewing

3. Philadelphia’s Soda Tax model may be a bunch of fizz.

http://www.forbes.com/sites/patrickgleason/2016/06/18/philly-soda-tax/#4e69a1411894

4. Everything has a story and a price. Mall owner PREIT's next big sale: Itself?

http://articles.philly.com/2016-06-12/business/73706070_1_preit-shareholder-value-portfolio

5. Activist Investors Have a New Favorite Target: REITs

http://www.nytimes.com/2016/06/08/realestate/commercial/activist-investors-have-a-new-favorite-target-reits.html?ref=commercial

1031 Exchange List and Buyer Requests

We are constantly updating our list of 1031 buyers and buyer requests. A recent sample of requests:

NYC Investor – Seeking centers with minimum 90% occupancy with $20 million minimum.

Mid-Atlantic Investor – Seeking blue-chip NNN asset up to $4 million

East Coast fund – Looking for grocery anchored centers over $10 million.

Chicago investment firm - Aggressively moving into the Mid-Atlantic. Deal size is $5 to $25 million - sweet spot is around $10 million. Looking for unanchored strips that need facade work, tenant re-positioning, deferred maintenance and/or other value-add characteristics.

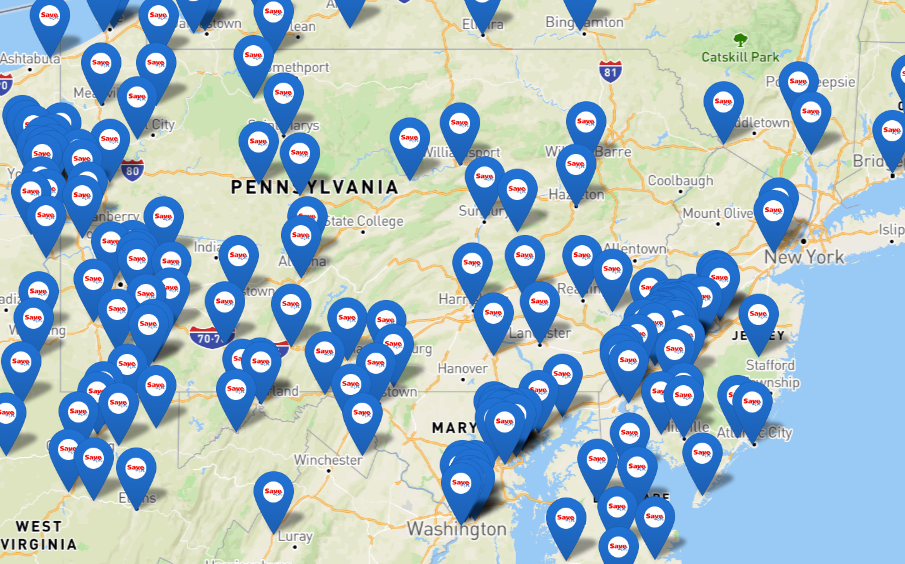

Philadelphia Investor - Seeking unanchored strips within a 100 mile radius of Philadelphia.

DC Investors (1031) - Looking for stabilized, blue chip, and grocery anchored centers under $25 million.

NY Fund - Seeking neglected, value-add centers under $15 million.

PA Investor- Looking for stabilized NNN assets under $5 million.

NJ Investor (1031) - Seeking solid NNN asset with long-term lease, willing to leverage up to $5 million.

To be added added to our 1031 exchange buyer list or inquire further - please email DDeRienzo@equityretailbrokers.com or call 484-417-2214 with buyer requirements or 1031 needs.