5 Things to Know About the Save-A-Lot Buyer, Onex Corporation

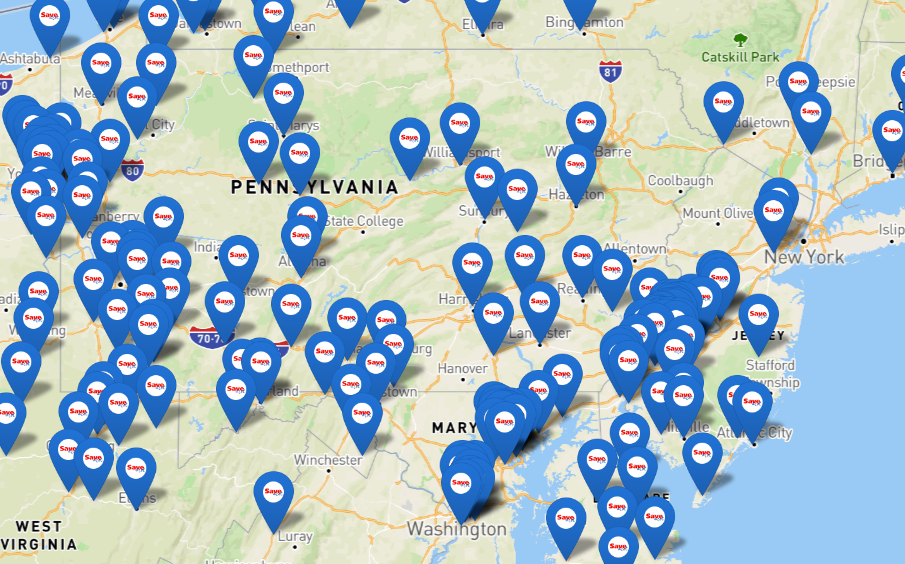

The recent acquisition of Save-A-Lot by Toronto-based Onex Corporation has left many landlords wondering about changes to the discount grocer's brand. The overall sentiment is generally positive for Save-A-Lot moving forward, despite increased competition from Aldi and other low-priced grocers.

Here are 5 things to know about Save-A-Lot parent company, Onex Corporation:

1. Onex is a Big Fish

Onex is one of the oldest and most successful private equity firms. Through Onex Partners and ONCAP private equity funds, they acquire and build high-quality businesses in partnership with talented management teams. Onex invests its capital together with capital from investors from around the world, including public and private pension funds, sovereign wealth funds, banks, insurance companies and family offices. The management of fund investors' capital provides Onex with expanded scale and leverage. Onex earns management fees on approximately $15 billion of assets under management and

has the opportunity to share in the profits of its investors through carried interest and incentive fee participation. This provides Onex enhanced returns from its investment activities. Today, Onex has approximately $23 billion of assets under management, including $6 billion of Onex' capital.

2. Proven Track Record

Since its inception in 1984, Onex has completed more than 480 acquisitions and recorded losses on just six of those investments. The typical holding period varies, but expect Onex to successfully exit

Save-A-Lot in 5-10 years.

3. Mountain of Cash

Onex has a surprisingly low (0.29%) dividend yield. By artificially suppressing the dividend payout, Onex can operate with significant cash reserves. The cash is sitting on the sidelines ready to be deployed

towards prime acquisition targets. Onex has a proven track record of increasing shareholder value

through the appreciation of its assets and realizing the returns upon a successful exit.

4. Plans to Grow the Brand

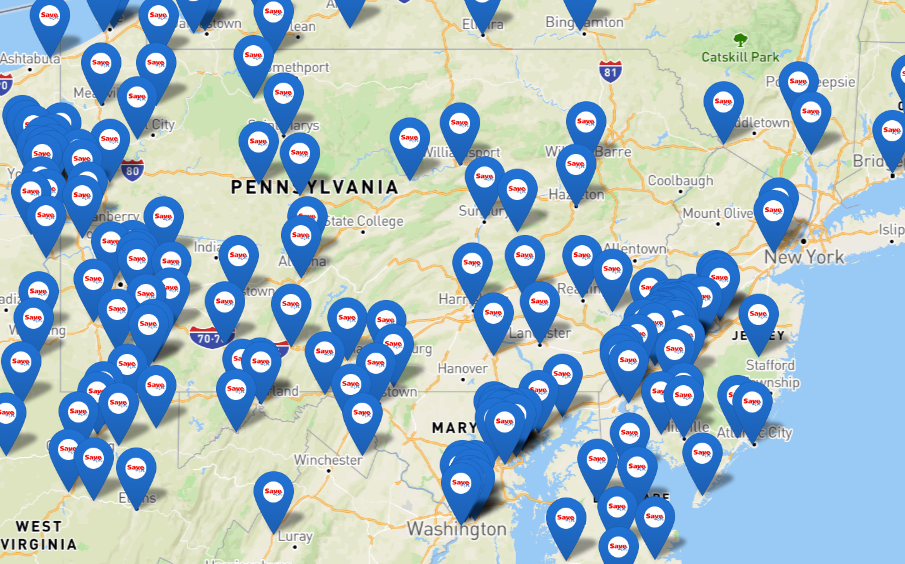

Watch for a methodical expansion effort. Moving forward expect Save-A-Lot to increase its footprint

in well established markets where brand equity can be leveraged during expansion efforts - particularly the East Coast. Save-A-Lot CEO Eric Claus recently commented in Supermarket News "... we've got another 1,400 stores from Colorado to the East served by distribution centers with a lot of room to grow."

5. Onex Lacks Retail Experience

Looking at the Onex portfolio, there is a limited track record when it comes to grocery retail. That's OK. As part of the deal, Supervalu will continue to offer support for the brand. Expect Supervalu to pick up some slack when it comes to operational items such as merchandising technology and payroll. However, look for upgrades to carry over from Onex's experience in high end manufacturing, data analytics and the ability to reinvest and ensure a predictable (and successful) exit.