Fall 2017 Market update with 30+ Shopping Center Comps!

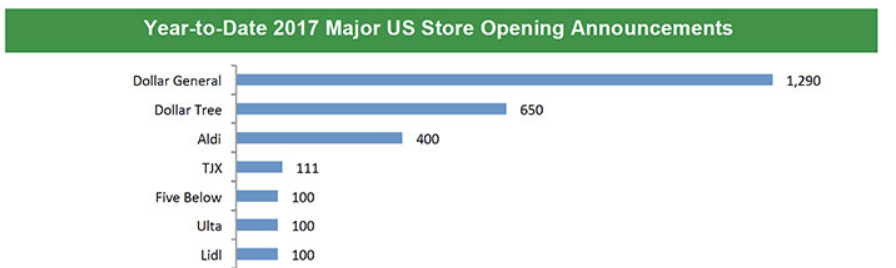

2017 saw an increase in the number of days on market for shopping centers. Generally taking 20% longer for deals to close. Cap rates have remained stable through 2017. The back-filing of junior and big-box space seems to be both the biggest challenge for landlords and greatest opportunity for upside. A challenge if the asset was purchased with rents at or near market rates. An opportunity if the center was purchased and value can be created via a big-box lease-up. We have seen time and again landlords hitting home-runs by securing a big-box tenant. We have also seen centers languish for years, as landlords fail to dedicate time, money, and resources to repositioning their shopping center. Our leasing team can easily count 3 dozen big box vacancies in the Philly MS (without breaking a sweat). That being said, there are still plenty of retailers in expansion mode. Here are a few leading the charge:

Just a few retailers leading the expansion charge. Not including QSR's, such as Wawa, Royal Farms, and Starbucks and medical concepts such as Patient First, Med Express etc.

10-Year Treasury: