2018 Trends and 2017 Market Recap

Despite rumblings of a retail apocalypse, multi-tenant retail assets remains one of the strongest asset classes, delivering healthy IRR's. Non-1031 exchange buyers are less aggressive than this time in 2016, with the market still near historically low cap rates. The common consensus among investors is an expectation of cap rates to rise 25 to 50 basis points by the end of 2018. The spread between asking price and closing price has also continued to increase, causing the market to shift away from a “seller’s market”.

Well-located shopping centers remain a staple investment

Investors are looking to well-located shopping centers supported by strong demographics. This theme has persisted over the past few years, and investors are likely to continue expanding their scope of viable shopping centers. As the cost of capital increases, investors will be loosening their acquisition criteria and look to riskier, higher cap rate assets in secondary and tertiary markets. Expect more capital to continue it's stream into the Midwest as well.

Cap Rates Have Held Steady

Most of 2017 saw cap rates hold firm at cap rates in the high 6's. Demand for strip centers is up and multi-tenant retail was one of the strongest performing asset classes in 2017. Look for the continued demand trend as investors search for internet-proof service and restaurant oriented shopping centers. However, transaction volume fell approximately 20% year over year. It can be assumed that higher quality assets are trading, thereby holding cap rates at their current level. Likewise, the decreased volume has translated into longer marketing and transaction periods.

Shifting Buyer Profile

Foreign investment into retail assets continues to remain strong. Despite capital-flow controls by the Chinese government, Asian buyers are still aggressively purchasing retail assets both small and large. Last year, foreign REITS saw transaction volumes exceed $2.9 billion, an increase of over $2.5 billion from 2015. Anecdotally, domestic buyers have begun to feel more comfortable with the political climate and any interest rate hikes will have a nominal effect on acquisition activity.

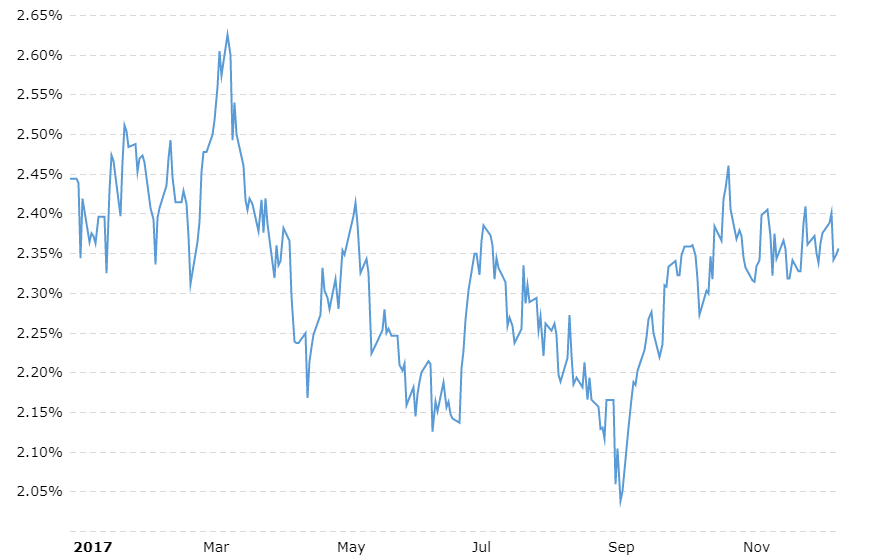

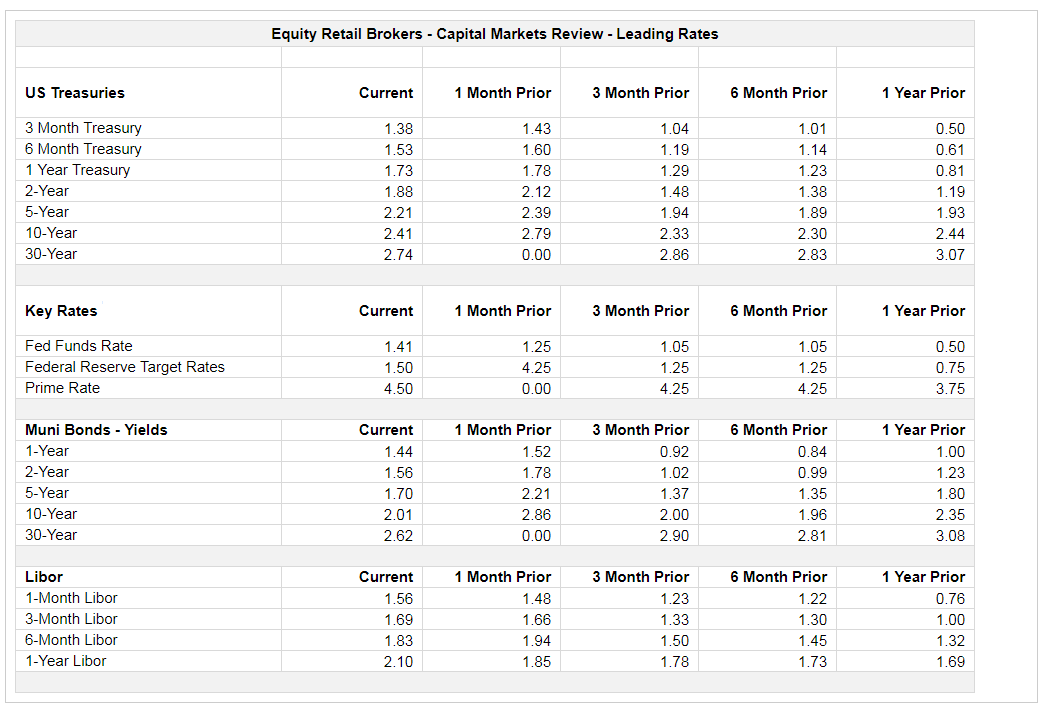

Upcoming Rise in Interest Rates

Since the start of 2017, the 10-year treasury has remained relatively flat (2.35% as of 12/14/2017), despite the Fed's recent rate hike. However, the Fed predicted in September that it would increase rates three times in 2018 and two more times in 2019. Looking forward, expect a 1% rise in interest rates to correlate to a 50 basis-point increase in cap rates. However, as we have seen in the past with retail real estate, can march to the beat of a different drum.