Using a Master Lease to Sell a Retail Asset

More than ever, retail assets are being offered (and sold) with master leases in place. The master lease trend has always been popular with shopping center developers who are looking to successfully exit a project prior to achievement of 100% occupancy levels. Now, we are seeing the master lease strategy being used by owners of legacy shopping centers as a means to achieve the highest possible price for their assets.

What is a master lease?

The master lease strategy is typically used in the sale of a shopping center when the center is occupied, but not 100%. The seller of the shopping center will then guarantee the rental income of any vacant spaces in the shopping center. Typically, the time frame for a master lease is the earlier of 1-2 years or upon lease-up of the vacant space.

Advantages of a Master Lease

- Allows seller to achieve the highest price for their asset.

- Expands the pool of buyers who are seeking a stable income stream.

- Eliminates risk to a buyer. Specifically, when covering debt payments.

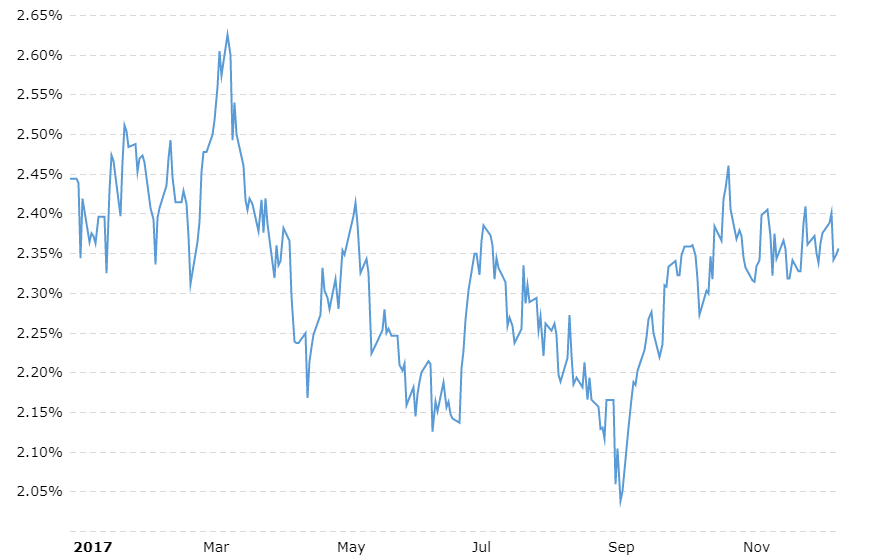

- Allows the buyer to obtain better financing terms via higher appraisal amounts.

Common Issues Related to the Structuring of a Master Lease

- What is the term of the master lease?

- What will the tenant screening/approval process look like? Will the new owner have a say in this process?

- Will the lease be guaranteed by the seller?

- Will funds equivalent to the value of the master lease be placed in an escrow account?

- If placed in an escrow account, will any remaining funds be split evenly between buyer and seller or will excess funds revert back to seller?

Furthermore, sellers need to be aware of diminishing returns above 95% occupancy levels. Many banks will assume an inherent vacancy and credit loss factor of 5% when underwriting the asset for a buyer. A seller may be guaranteeing more than what is necessary to achieve the desired outcome of the master lease.

The master lease strategy, when properly negotiated and structured with both buyer and seller protections, can offer significant benefits to both parties and eliminate common hurdles to the successful sale of a shopping center.